Over the coming decade, millions of privately held businesses will be going up for sale. Whether the situation involves a “baby boomer” looking for an exit to fund retirement, or a company’s ownership looking to cash out to a strategic partner, they will all need trusted advisors. This makes deal flow potential for business owners, directors and managers, investment banks, M&A firms, transaction lawyers, family offices, private equity firms, and other interested parties higher than ever.

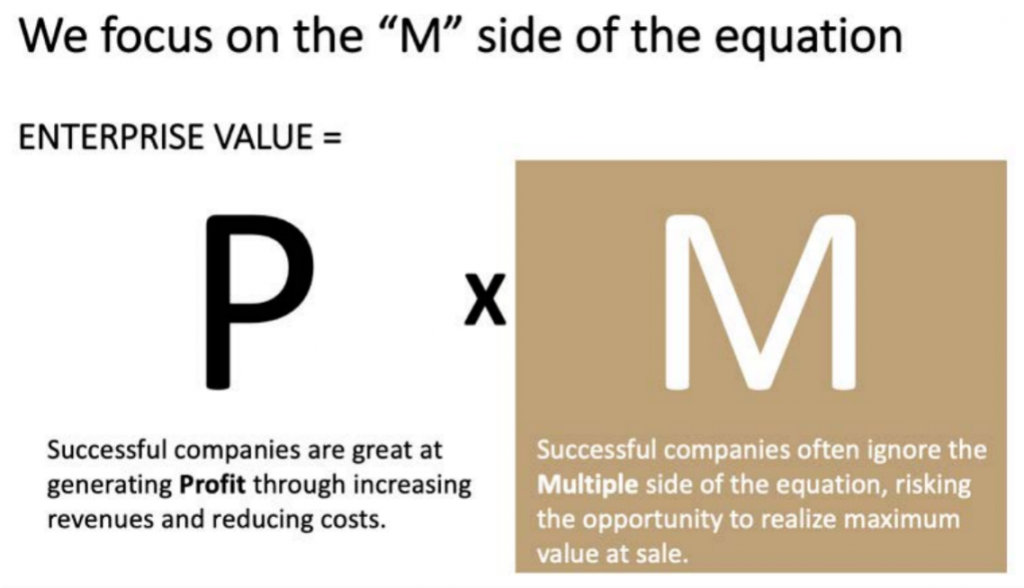

However, the reality is that many of these businesses, while successful at generating profit through strong revenue numbers and cost control, have ignored the multiple side of the valuation equation. Focusing on the multiple tends to be an underserviced requirement for private companies. As a result, these businesses are selling themselves short in the effectiveness of their ongoing operations and are risking the opportunity to realize maximum value at exit.

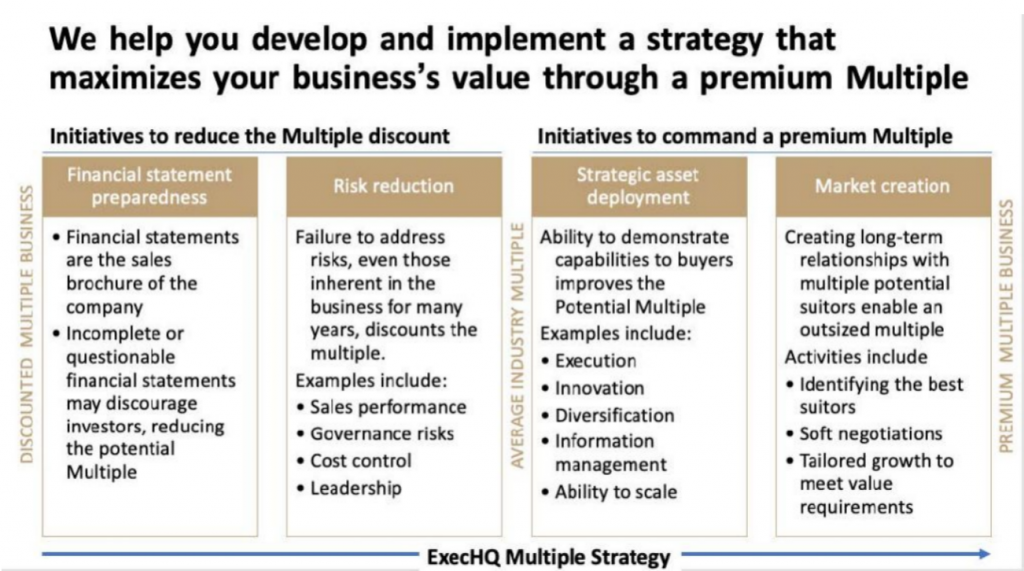

So, what is the best way to ensure the multiple is optimized in companies looking for an exit? The answer is to defer that exit until the multiple is enhanced through the deliberate advisory program offered by ExecHQ™ MULTIPLE. ExecHQ partners with business owners, M&A firms, and investment banks to shepherd these businesses through a MULTIPLE enhancing program, thereby making them more attractive to potential buyers. Our former C-Suite executives work hand in hand with each business and their M&A advisors, improving the valuation MULTIPLE. Then, when the company is ready to sell, we deliver the company to their M&A firm for the transaction process.

To state the obvious, enhancing the valuation MULTIPLE brings significant value to all stakeholders. For the business ownership, the benefits of this new ExecHQ™ service offering include:

- Opportunity to realize significantly outsized value at M&A transaction through an increased valuation.

- A slower, more intentional journey (over 9 months or more) reduces the emotional strain of selling a business.

- Using ExecHQ’s fCxO* resources, your client receives extensive experience, deep expertise, and on-demand pricing, nationwide and in many international locations.

*fractional Chief X Officer – C-Suite executives with extensive experience

For the involved M&A firm, the benefits include:

- Retaining clients that could be lost due to a lack of preparedness for a transaction.

- Remaining involved with the client through the entire process with minimal time and resource

commitment. - Higher transaction values.

- A low-risk, no-regret step for clients to take before committing to selling their business, increasing

the likelihood of a transaction.

To illustrate the value of this service, a recent project completed for an IT professional services company increased the multiple of revenue from a typical 0.8-1.4 to an astounding 2.5X. ExecHQ MULTIPLE is truly a win-win proposition for you and your prospective client.

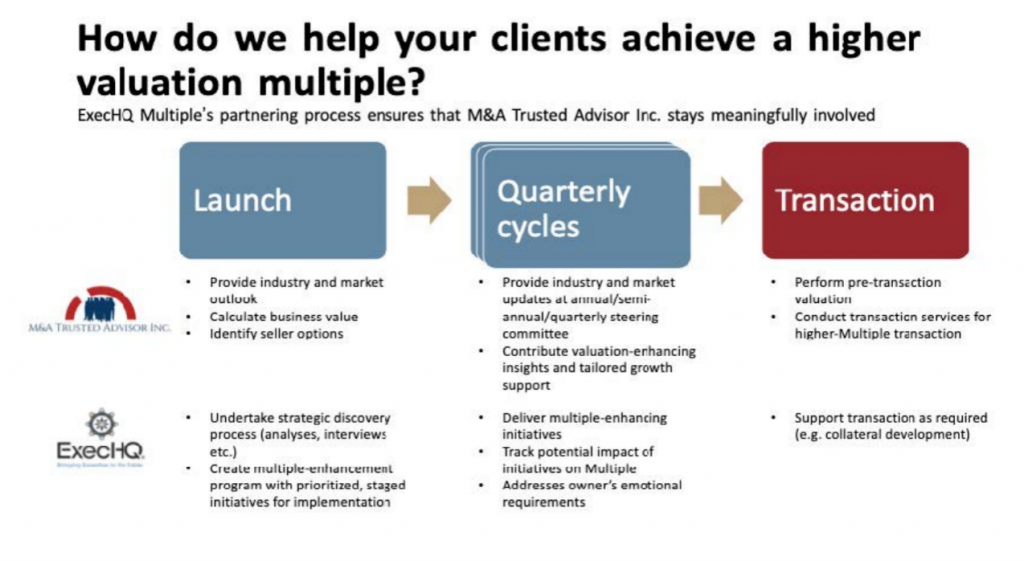

The process starts with a joint business assessment meeting with all stakeholders, including business ownership, board members, the management team, the M&A advisor, and ExecHQ to determine the company’s deficits in their expected multiple. We identify opportunities to improve the value, execute on those opportunities, and help the M&A advisor to articulate the quality of the business to the “buy-side.” The program is executed in quarterly cycles, and we bring all stakeholders in on quarterly steering committee meetings to ensure complete visibility on the program and progress made to that point. In this way, the involved M&A firm and other trusted advisors can offer valuable input to better position the business toward potential buyers.

To effect lasting change within all aspects of the MULTIPLE side of the equation, a deliberate program of advisory projects lasting from nine to eighteen months (and sometimes longer) is necessary. ExecHQ is advantageously positioned for such long-term project work. With over one hundred C-suite executives with immeasurable expertise in virtually every area of business and representing numerous industries, we have the bandwidth and resources to handle all aspects of the company’s MULTIPLE, from financial reporting to leadership, governance, risk mitigation, customer and product diversity, planning and execution, and everything in between.

Our Process:

ExecHQ is prepared to guide businesses nationwide through the MULTIPLE experience, in concurrence with their M&A advisors. We look forward to partnering with you for the benefit of all stakeholders. Finally, you can ensure the best valuation on the business you worked so hard to build. To learn more about ExecHQ™ MULTIPLE and the many other services offered by ExecHQ™, contact our ExecHQ™ MULTIPLE program leads Jon Rothbart or Baron Lukas at exechq-multiple@exechq.com.